Childhood & Early Life

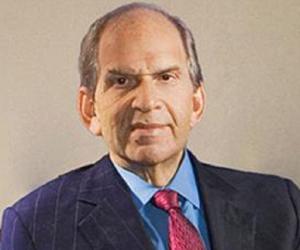

Mikhail Prokhorov was born on 3 May 1965, in Moscow to Dmitri and Tamara Prokhorov. Dmitri Prokhorov was a lawyer who headed the ‘Soviet Committee of Physical Culture and Sport’ while Mikhail’s mother, Tamara, was employed as a materials engineer at the Institute for Chemical Materials. Mikhail has one elder sister Irina

Dmitri Prokhorov, despite hailing from a rich kulak family, had an impoverished upbringing as parents were persecuted as class enemies under the Bolsheviks and again under Stalin.

Mikhail Prokhorov lost his parents during his youth when both of them succumbed to heart disease when they were in their late 50s.

He was extraordinarily passionate about work and establishing himself—a trait that had been instilled in him by his family. He had also developed a strong affinity for sports in his early years and became a member of the Soviet Youth organization, Komsomo.l when he was in his teens.

In 1983, he was conscripted into the army as an 18 year old and served in the elite missile corps for two full years following which he enlisted in the Communist Party of Soviet Union. Mikhail lived in his parents’ flat along with his sister and her daughter while attending Moscow Financial Institute.

After graduating in 1989, Mikhail landed a management level job in International Bank for Economic Cooperation and stayed with the organization for three years. Subsequently, he helmed the management boards of ‘MFK Bank’—an international financing firm—and the United Export Import Bank a.k.a ‘Onexim Bank’.

Alexander Khloponin, his college friend, and Vladimir Potanin, ex-deputy PM whom Prokhorov became acquainted with through Khloponin, also served on the management boards of MFK and Onexim banks. He partnered with Potanin to set up the Onexim Bank in 1993.

A Trailblazing Professional Career

Mikhail Prokhorov’s association with Vladimir Potanin proved to be very momentous in the long run as their business partnerships enabled both of them to become billionaires.

In 1992, he collaborated with Vladimir Potanin to establish ‘Interros’, a holding company that they transformed into a conglomerate having stakes in several infrastructural sectors.

Mikhail Prokhorov and Potanin later on became joint stockholders at MFK Bank with the former chairing the corporation’s board. They used Interros as an investment trust to purchase a 25% stake in Norilsk Nickel—one of the world’s largest palladium and nickel mining and extraction corporations.

Following the balkanization of USSR in December 26, 1991, an unbridled privatization drive ensued, facilitating Potanin and Prokhorov to acquire a major stake in Norilsk Nickel at a throwaway price. Owning a substantial chunk of Norilsk shares, they became de facto owners of the mining company.

He first tasted financial success, when he was the Chairman of the Board at the MFK Bank (International Finance Company) from 1992 to 1993. The bank became a depository institution for the government and acquired Soviet assets to the tune of US$300 to US$400 million.

In 1993, he became the Chairman of the Board for Potanin’s Onexim Bank. The bank became the paying agent for Finance Ministry bonds and a servicing bank for the City of Moscow’s external economic activities.

Together with Potanin, he secured loans and treasury bonds for and on behalf of the Soviet regime as well as handled bankrupt firms which ultimately enabled them to amass billions quite effortlessly. Onexim as the government’s blue-eyed-boy had a free run during Russia’s umbrageous era of privatization in the 1990s.

Onexim was like a colossus straddling the world of finance in Russia which was still smarting from the aftershocks resulting from USSR’s disintegration. The newly formed government was badly in need of loans and Onexim managed auctions on its behalf, where the highest bidder(s) would secure the rights to loan money.

The loans advanced to the government would be collateralized with shareholdings in newly privatized firms that once used to be public enterprises. More often than not, the administration defaulted on the mortgages which eventually paved the way for Onexim bank to automatically own the collateral, and technically gain control of the private firm.

Onexim took over Norilsk Nickel by conducting the auction in an unethical way, somewhat similar to what is known as insider trading in the present times. Nevertheless, the bank gained total control of Norilsk in 1997 through a rigged bidding process, when the government was unable to reimburse the loan,

Acquiring Norilsk Nickel and Modernizing the Mining and Smelting Behemoth

After Onexim Bank gained administrative control of Norilsk Nickel, Mikhail Prokhorov proceeded to streamline the operations of the mining firm by selling its non-mining acquisitions. He wanted to restructure and rationalize the intensely complicated operations of the mining behemoth and make the business profitable which he eventually did.

His restructuring measures included retrenching the workforce, and introducing performance-oriented incentive programs to improve overall operational efficiency. He also took bold steps to curb pollution by investing hugely in pollution control technology as Norilsk’s emission of sulfur dioxide exceeded that of all the industries of France put together.

As Norilsk Nickel became a profit-making enterprise under Prokhorov’s stewardship, he channelized bulk of the profits—a whopping US$8.5 million—into establishing Polyus Gold, Russia’s biggest gold producer as a spinoff from Norilsk. He stepped down as Norilsk’s CEO in 2007 as he was looking forward to purchase a power supply company.

Numerous observers alleged that Potanin decided to call off his partnership with Mikhail in Interros, the holding company for Norilsk, because of the latter’s scandalous arrangement of prostitutes for rich guests in a French alpine resort. Both of them entered into long-drawn negotiations to set apart their stakes in Interros.

Establishing ONEXIM Group: A Private Investment Firm

In April 2007, after splitting up Interros, Mikhail Prokhorov set up the ONEXIM, a private investment endowment, especially for encouraging R&D in hydrogen fuel cells and nanotechnology. The investment fund had an overall corpus of US$17 billion, the lion’s share of which came from the proceeds following the carving up of Interros.

In April 2008, Mikhail invested his Norilsk’s stake in United Company Rusal, another Russian mining giant owned by compatriot billionaire Oleg Deripaska. In return, he received US$5 billion cash, US$2 billion in debt obligations, and about 14% of Rusal’s stock.

Prokhorov’s deal with Rusal proved to be fortuitously opportune as stock markets crashed a few months later disastrously due to unexpected dip in oil prices. The unexpected fall in the prices of oil, resulted in an economic downturn, halving down valuation of the majority of Russian firms.

The meltdown in the global economy in 2008 proved to be a mixed blessing for Mikhail Prokhorov. Although his stocks in several firms declined in value considerably, he capitalized on the economic downturn by exploiting his massive funds reserve to enter into strategic contracts in non-mining segments.

Notable amongst Prokhorov’s high-profile investments during the global financial crisis was the acquisition of 50% of Renaissance Capital, a private investment bank based in Moscow, for $500 million. He also acquired a significant stake in Russia’s foremost financial news portal-RBC.

Global Investments & Business Deals

In 2009, Mikhail Prokhorov made a bid to become the major shareholder of ‘New Jersey Nets’, a NBA basketball team. In 2010, the NBA gave assent to Mikhail Prokhorov’s offer and he became the first non-North American team owner in the NBA.

Political Forays

In May 2011, Mikhail Prokhorov joined the Russian pro-business political party ‘Right Cause’. But, in September 2011, he resigned from the party.

In December 2011, he announced his decision to contest the 2012 presidential election against Vladimir Putin as an independent. He lost the election and gained only 7.94% of vote.

Personal Life

A self-established billionaire with a net worth of approximately US$8.9 billion, Mikhail Prokhorov is one of the wealthiest individuals as well as one of the most eligible bachelors in the world. He is a kickboxing, snow skiing, and jet skiing enthusiast, heads the Russian Biathlon Federation, maintains his own website, and is good at playing the guitar.